Hong Kong, under the storm of tariffs, lays down the law!

2025-04-18

When gold is no longer the only thing: What are the "new safe havens" to which global capital is flowing?

2025-04-25Japanese real estate has long been a favorite among Chinese investors.

In the near future.Tokyo's core residential market shows strong gains, sparking global capital attention:

Related news is below:

In January, the listing price of second-hand apartments in Chiyoda and Minato-ku topped 200 million yen.

In February, the listing price of a second-hand apartment in the center of Tokyo topped 150 million yen.

In 2025, the land price of commercial land in Tokyo's 23 wards rises by 11.81 TP3T.

According to authorities, it is predicted that in the coming periodApartment prices in Tokyo's 23 wards will continue to rise.Why?

01

Climbing construction costs create a price bracket

Over the past decade, the Japanese construction industry is under double cost pressure.

▶ Supply Chain Reorganization Pushes Up Raw Material Costs

Global lumber and steel futures index has continued to rise since 2021, the epidemic triggered by supply chain disruptions, the infrastructure race between China and the U.S. spawned a blowout in demand, coupled with the Russian-Ukrainian geopolitical conflict pushed up the price of energy, so that the cost of building materials transportation costs steeply increased by 30%.

▶ Structural imbalance in the labor market

The aging of fewer children eats into the labor dividend, with daily wages for construction workers up 421 TP3T from a decade ago, directly pushing up the baseline of development costs.

02

Increase in high-priced apartments

In recent years, large-scale Japanese developers have been located in core areas that are economically prosperous, conveniently located, and well-supportedDevelopment of high-end residential projectsThe

These high-end apartments are meticulously designed and furnished with high quality materials and equipped with intelligent living facilities.

Its high cost and expensive selling price, raising the level of home prices throughout the region.

03

Increase in the number of affluent people

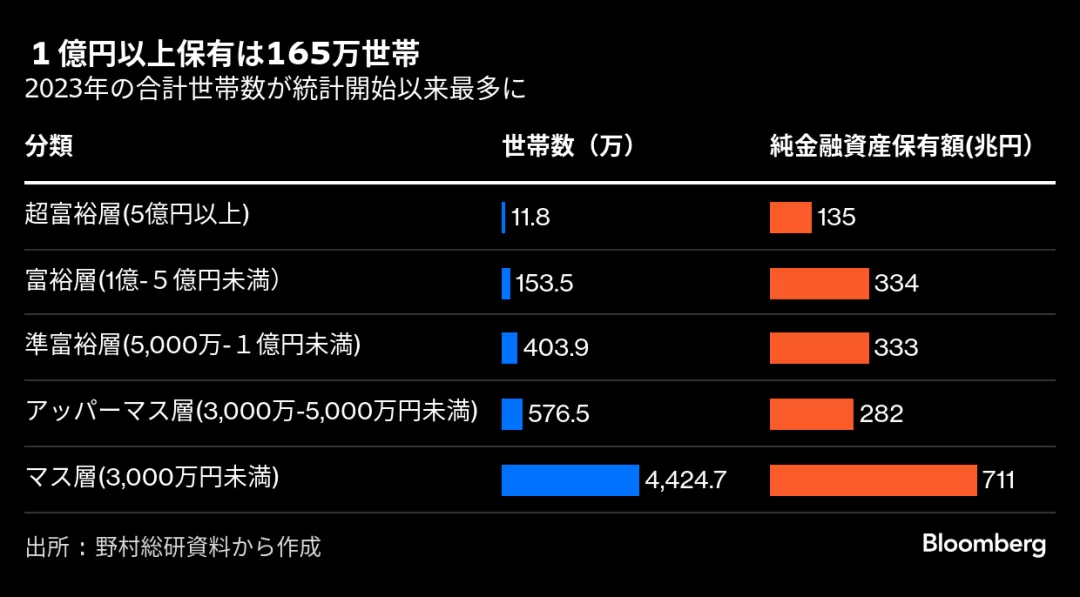

New NRI research reveals thatJapan's ultra-high-net-worth households (with investable assets of more than 100 million yen) have surpassed the 1.65 million mark.That's a surge of 671 TP3T from five years ago.

These nouveau riche show a strong preference for urban core assets - 76% of the respondents clearly indicated that their next home purchase will still be locked within the five-kilometer circle of the metropolitan center, and theirstrong purchasing powerbecome a direct driver of rising home prices.

04

Increased demand from investors

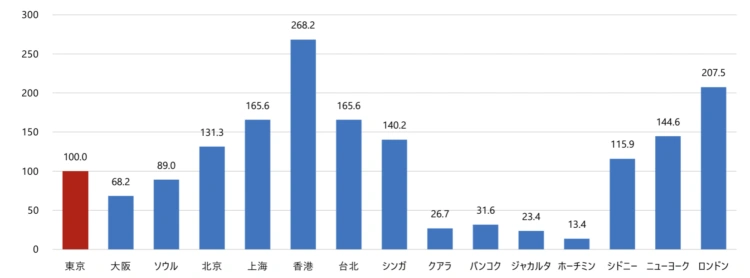

The international comparative advantage of Tokyo house prices is beingAttracting hot moneyThe

Japan Real Estate Association data show that among the 15 benchmark cities in the world, Tokyo residential unit price is only the ninth, still less than 55% of the same type of property in Hong Kong.

Overlaying the yen's exchange rate, which continues to hover at a low level, overseas investors are pouring in at a record pace:In the first quarter of 2025, the share of transactions by foreign buyers has reached 181 TP3T, a four-fold spike from the pre-epidemic period.

These are the main reasons why Tokyo apartment prices continue to rise.

The attraction of Japanese real estate is itsfreeholdtogether withComprehensive legal protection systemThisAdds security to investments. Regulated leasing regulations and transparent transaction processes make Tokyo real estate a premium safe-haven asset in times of global economic volatility.

If you are interested in investing in Japanese real estate, please feel free to contact us!