Osaka's hosting of the World Expo has caused Tokyo B&B rates to skyrocket 1.8 times?

2025-04-18

Is it still worth getting into Tokyo real estate, which Chinese buyers are going crazy for?

2025-04-25At present, the international economic situation is in flux, with the United States of America"Reciprocal tariffs"It set off a global pandemonium and created an uproar in the market.

A review of the "reciprocal tariffs" key milestones:

-- April 2: Trump announces the launch of "reciprocal tariffs", including 341 TP3T tariffs on Chinese goods.

-- April 9: Tariffs on China are raised again to 501 TP3T, with the cumulative rate rising to 1,041 TP3T.

-- April 10: Tariffs on China are raised further to 1,451 TP3T and the program of tax increases on other countries is suspended for 90 days.

However.Hong Kong's status as a free trade portThe new policy is a "land of headwinds" in the storm of high tariffs, providing a safe haven for China and global trade.

01

Hong Kong to maintain free port status

After the announcement of the "reciprocal tariffs", global markets reacted sharply!

Even Hong Kong's "small parcel tax exemption" policy has been abolished, effective May 2nd.

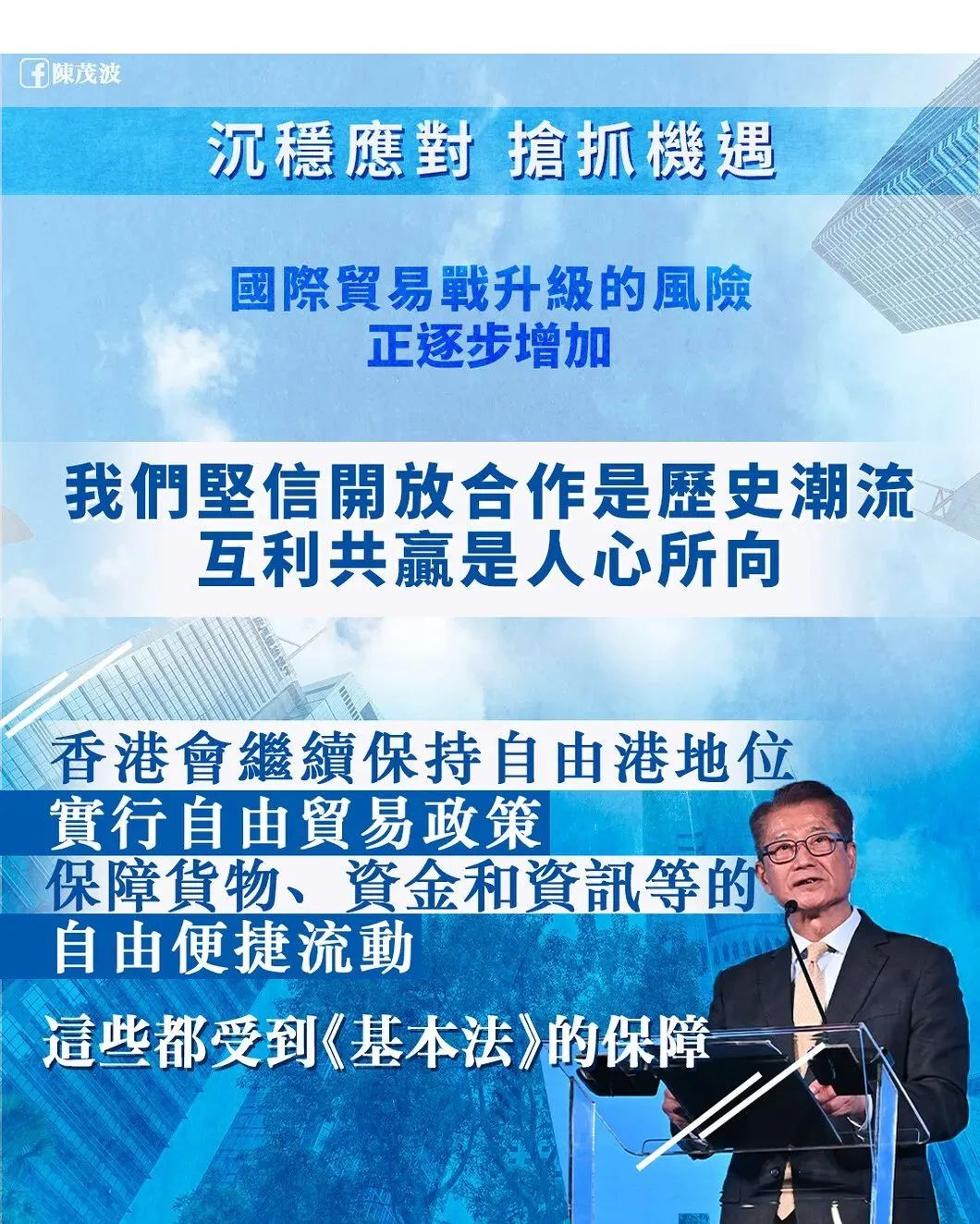

In this context.The attitude of the HKSAR Government is particularly clear!

On April 3, a spokesman for China's Hong Kong SAR government said:Hong Kong, China, is a free portHaving always supported and practiced free trade.Tariffs have never been imposed on all imports, including American products, and "the United States' imposition of tariffs on Hong Kong products on the grounds of the so-called reciprocal tariffs runs counter to common sense logic."

This means that even if the United States announces tariff increases on Hong Kong products.The Hong Kong government also does not intend to impose tariffs on U.S. products at this time.

On April 6, the Financial Secretary of the HKSAR Government, Mr. Paul Chan Mo-po, wrote in an accompanying note by the Financial Secretary titled "Responding with Composure and Seizing Opportunities":"We will continue to maintain our status as a free port and pursue a free trade policy.Guarantee the free and easy movement of goods, funds, information, etc."

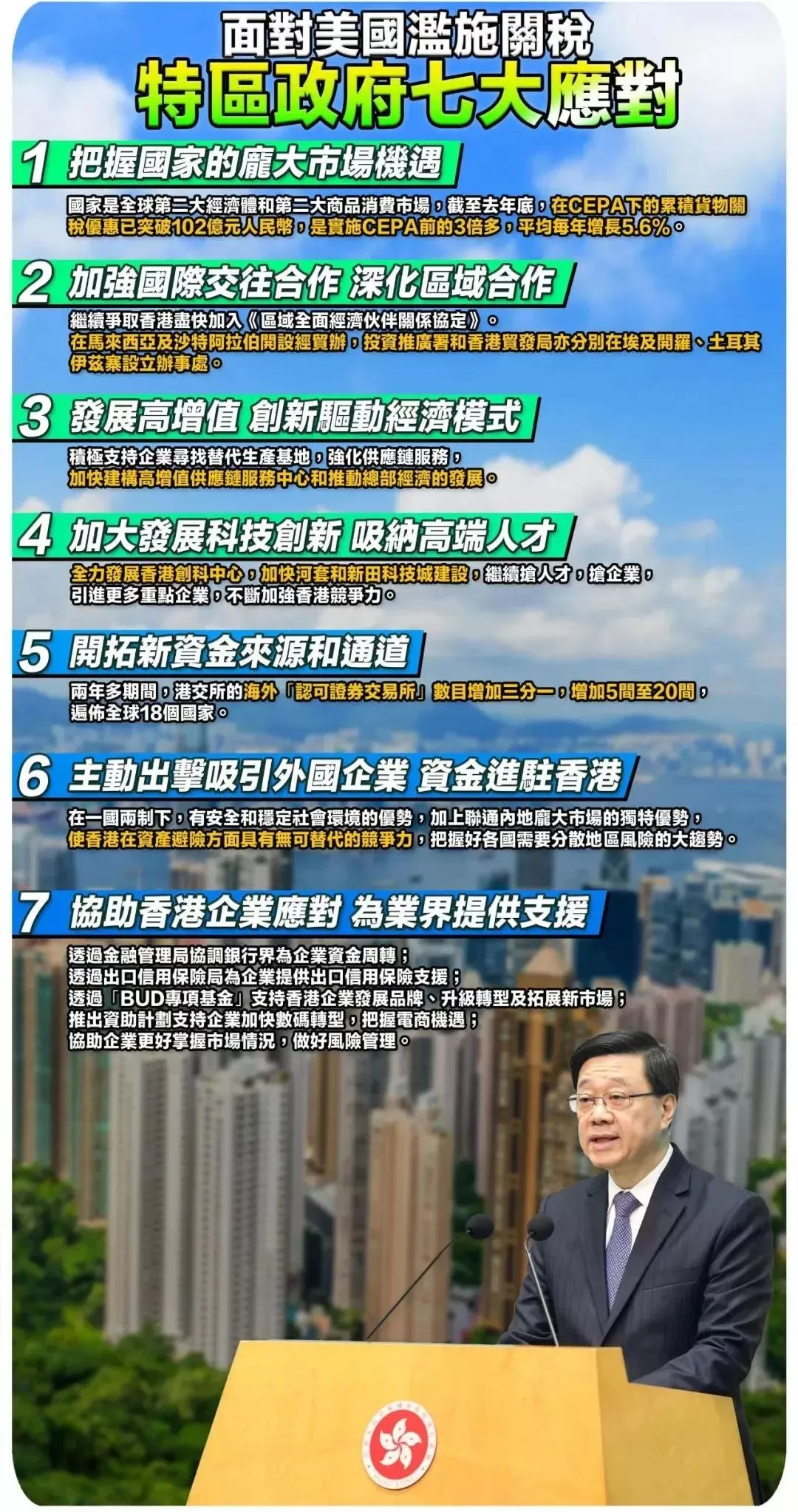

In addition, the SAR Government has also responded proactively by formulating theA seven-pronged strategy to ramp up efforts to meet the tariff challenge.

These seven strategies include:

As Trump's tariffs on China and other countries have heightened global trade tensions, Hong Kong's announcement that it will not follow suit seems somewhat unusual.

Against the backdrop of increasing global economic uncertainty and the shadow of a trade war, Hong Kong, with its unique tax exemption policy, may become a haven for many enterprises and investors.

02

tariff war

Hong Kong's unique advantages

In the current trade friction between the U.S. and ChinaHong Kong has ushered in a new opportunity to become a new market and a new platform for global enterprises, with unlimited development potential.

As a cosmopolitan city, Hong Kong, with its unique advantages, is expected toReceive global capital inflows, reshape the supply chain system and consolidate the position of financial center.These positive factors have helped Hong Kong to stand out from the wave of anti-globalization, achieve upward mobility against the trend and inject new vitality into the Hong Kong economy.Hong Kong's Superior Business Environment

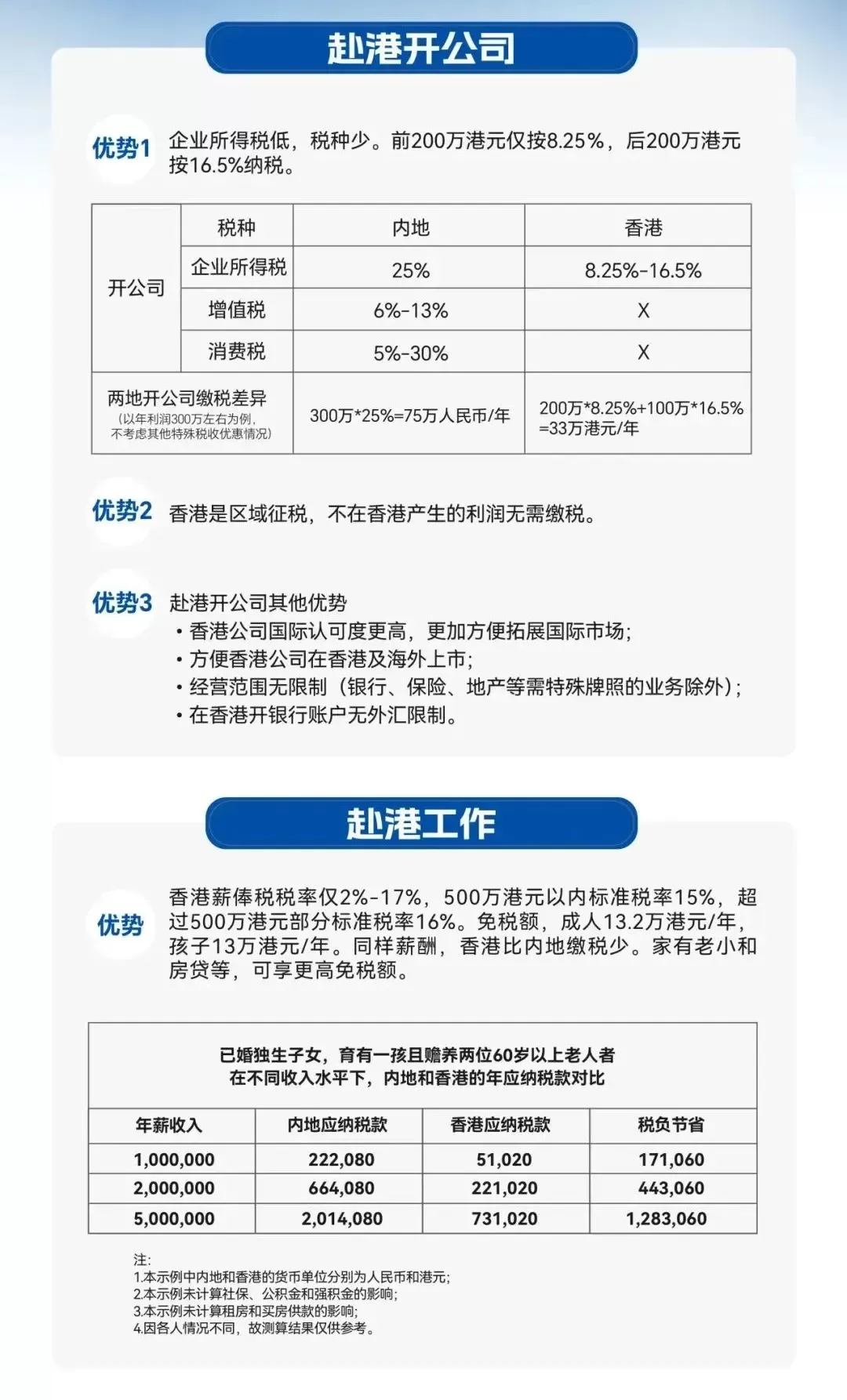

Hong Kong has always been known asTax depressions, with their simple tax systems and lower tax rates.Many entrepreneurs are attracted to run to Hong Kong to register their companies.

The Hong Kong profits tax rate is 16.5% (8.25% for the first 2 million profits), which is much lower than the combined tax burden of 25% EIT + 20% dividend tax in the Mainland.

Leading level of financial sector development

Hong Kong is a global leader in the development of its financial industry, with its financial markets coveringStocks, bonds, foreign exchange, futures, optionsand many other areas, and each has a high degree of activity and depth.

The Hong Kong Stock Exchange, as one of the world's leading stock exchanges.attracted a large number of high-quality enterprises to go public for financing.Large market capitalization and high trading activity.

Hong Kongbanking industryEqually developed, Hong Kong'sInsurance, asset managementand so on also occupy an important position globally and have contributed significantly to the diversified development of Hong Kong's financial markets.

A number of Hong Kong's inbound investment/entrepreneurship policies support

Hong Kong has alwaysEncouraging talents to invest and set up businesses in Hong Kong.Relaxation of application requirements for new immigrant investors, optimization of the company registration process, subsidies for small and medium-sized enterprises (SMEs) to start up businesses, etc!

01 Lowering the threshold for investment immigration

The net asset holding period has been reduced to six months, family asset sharing is permitted, and investments are permitted in wholly owned family offices.

02 More flexibility in company registration

Allow Hong Kong-registered listed companies to hold and dispose of repurchased shares in treasury under certain conditions, and encourage companies to adopt a paperless approach to communications.

03 Highly supportive policies for SME entrepreneurship

From the Accelerator Programme at the start-up stage to the BUD Special Fund and the Marketing and Industrial Organizations Support Fund at the growth stage, a total of $1.5 billion has been injected, and the application for arranging the SME Financing Guarantee Scheme has been optimized to provide financing guarantee.

Under the current situation of ongoing trade friction between China and the United States, Hong Kong's role as a free port is a guarantee of economic stability and aThe "golden key" for companies to unlock their business landscape.

Meanwhile.Hong Kong IdentityThe policy advantages, resource convergence and development potential are making it an ideal investment choice across economic cycles.

If you are interested in applying for a Hong Kong identity and doing business in Hong Kong, please feel free to contact Hop Fung Group!